20 Best Tips To Selecting AI Stock Investing Analysis Sites

20 Best Tips To Selecting AI Stock Investing Analysis Sites

Blog Article

Top 10 Suggestions To Determine The Integration And Compatibility Of Ai-Based Stock Predicting/Analyzing Trading Platforms

AI platforms for trading stocks that forecast and analyze stocks based on AI require compatibility with one another. An AI platform that is seamlessly integrated with your existing tools and workflows will increase efficiency and productivity. Here are the 10 best suggestions for evaluating the compatibility and integration between these platforms.

1. Check Brokerage Integration

Check that your platform works seamlessly with the brokerage or trading service you prefer.

Trade Execution: Determine if the platform allows direct trade execution by the broker integrated.

Account synchronization: Verify that the platform can update in real-time account balances and positions as well as transaction history.

2. Check API availability

API access: Make sure that the platform has an API available to developers who want to automate workflows or create custom tools.

API documentation: Verify that the documentation for the API has clear examples with examples of use.

Rate limits: Determine whether there are acceptable rates for the API and if it can handle your anticipated usage volume.

3. Evaluation of Integration Tools from Third Parties

Popular tools: Check if the platform can be integrated with programs such as Excel or Google Sheets.

Export/import of data - Make sure that the platform allows for easy data export/import to/from other tools.

Extensions/Plugins: Verify whether the platform is compatible with extensions or plugins for enhanced features.

4. Test Compatibility Operating Systems

Desktop compatibility: Ensure that your platform is compatible with the operating system of choice (Windows, macOS or Linux).

Mobile compatibility: Check whether the platform has an app for mobile devices on iOS and Android.

Web-based access (for additional flexibility): Verify that the platform is accessible via an internet browser.

5. Analyze Data Integration Capabilities

Data sources: Make sure whether the platform is compatible with multiple data resources (e.g. market data sources or news feeds).

Real-time data streams: Ensure that the platform has the ability to incorporate real-time information for up-todate analyses.

Make sure that your platform supports the import of historical data for backtesting or analysis.

6. Testing of cloud and on-premise compatibility

Cloud-based platform: Accessible any time, anywhere, as long as you have an Internet connection.

Solutions on-premise: If you prefer on-premise deployment, confirm if the platform supports it.

Check for hybrid options. This is a model which combines cloud capabilities with on-premises.

7. Check for Cross-Platform Synchronization

Device synchronization. Make sure that settings and data are synchronized across all platforms (desktops tablets and mobiles).

Make sure that any changes made to one device are immediately reflected on all devices.

Check the platform to see whether it allows data or functionality access even offline.

8. Verify the whether trading strategies are compatible

Automated or Algorithmic trading: Make sure that the platform you use for trading supports these strategies.

Custom indicators. Check whether the platform permits you to utilize scripts or technical indicators.

Strategy backtesting: Check if the platform supports backtesting trading strategies with historical data.

9. Review Security and Compliance

Data encryption: Make sure the platform uses encryption both for data in transit and at rest.

Authentication Check to see if your platform supports an authentication method that is secure (e.g. 2-factor authentication).

Regulative Compliance: Determine if your platform complies the relevant regulations.

10. Test Scalability and Performance

Scalability is crucial. The platform should be able to handle the ever-growing quantity of data, as well as the number of users.

Performance during load: Determine whether the platform performs well in volatile markets.

Resource usage: Make sure the platform makes efficient use of system resources like memory, CPU and bandwidth.

Bonus Tips:

User feedback: Study user reviews and testimonials to evaluate the integration capabilities of the platform.

Trial period: Take advantage of a trial or demo to discover how the platform can be integrated with other software and processes.

Customer Support: Ensure that the platform provides robust support to help with integration issues.

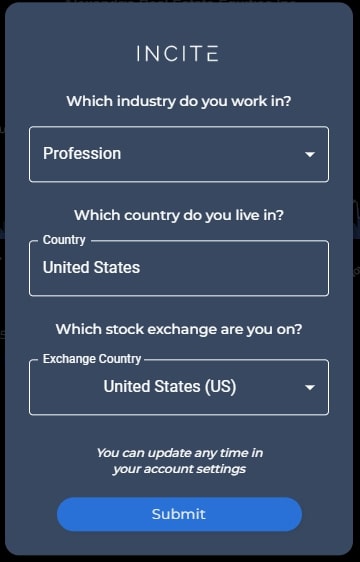

You can assess the compatibility, integration, and efficacy of AI stock trading platforms by following these tips. Check out the top learn more here about trading ai for site info including best ai trading app, incite, best ai stock, ai stocks, ai for stock trading, best ai stock, ai for stock predictions, ai investing, investing ai, ai investing platform and more.

Top 10 Tips To Assess The Risk Management Of Stock Trading Platforms That Use Ai

Any AI trading platform that predicts or analyzes stocks has to include risk management that is crucial to safeguard your capital and limiting losses. A platform with strong risk management tools will assist you in navigating volatile markets, and make educated choices. Below are the top 10 tips to evaluate the risks management capabilities of these platforms:

1. Review Stop-Loss and take-profit features

Customizable levels: Ensure the platform allows you to define take-profit and stop-loss levels for specific strategies or trades.

Find out if the platform allows the use of trails stops. They will automatically adapt themselves when markets move in your favor.

Guaranteed stops: Verify whether the broker offers guaranteed stop-loss orders, which ensure your position is closed at the exact price even in markets that are volatile.

2. Tools to Measure Positions

Fixed amount: Ensure that your platform allows you to create positions based on a certain amount of money fixed.

Percentage: See whether you are able to set your position sizes in percent of the total value of your portfolio. This will enable you to manage risk in a proportional way.

Risk-reward rate: Check whether you are able to determine the risk-reward ratio for specific strategies or trades.

3. Make sure you have Diversification Support

Multi-asset trading : Ensure that the platform allows traders to trade across various asset classes, like ETFs, stocks, as well as options. This will allow you to diversify your portfolio.

Sector allocation: Ensure that the platform is equipped with instruments to monitor exposure to different sectors.

Diversification of geographical areas - Make sure that the platform offers trading on international markets. This will help spread geographical risks.

4. Evaluation of leverage and margin controls

Margin requirement: Verify that the platform clearly outlines any margin requirements applicable to leveraged trades.

Find out if your platform lets you to limit leverage to control the risk of exposure.

Margin calls: Make sure you get timely notifications from the platform in order to prevent account liquidation.

5. Review the risk Analytics and Reporting

Risk metrics. Make sure your platform is equipped with the most important risk indicators (e.g. VaR Sharpe Ratio, Drawdown) pertinent to the portfolio you are managing.

Analysis of scenarios: Make sure that the platform enables you to create different scenarios for the market in order to evaluate risks.

Performance reports: Ensure that the platform provides you with detailed information on the performance of your investments, including returns that are adjusted for risk.

6. Check for Real-Time Risk Monitoring

Portfolio monitoring: Make sure the platform you use allows you to monitor your portfolio in real time.

Alerts & notifications: Verify the ability of the platform to send real-time alerts for risksy events (e.g. breaches of margins or Stop losses triggers).

Check for customizable dashboards that provide a comprehensive overview of your risk profile.

7. Assess Stress Testing and backtesting

Stress testing: Ensure the platform you use allows you to test your strategies or portfolio in extreme market conditions.

Backtesting - See whether your platform permits you to backtest your strategies using old data. This is an excellent way to measure the risks and determine the effectiveness of your strategy.

Monte Carlo: Verify the platform's use of Monte Carlo-based simulations to assess the risk and modeling a range or possible outcomes.

8. Risk Management Regulations Compliance Assessment

Ensure that the platform meets the requirements for regulatory compliance (e.g. MiFID II regulations in Europe, Reg T regulations in the U.S.).

Best execution : Check to find out if your platform uses best execution procedures. This will ensure that trades will be executed for the best possible price, minimizing the chance of the chance of slippage.

Transparency. Verify that the platform is clear and makes clear disclosures of risks.

9. Verify that the parameters are controlled by the user.

Custom risk rule: Make sure that your platform permits you to create custom risk management guidelines (e.g. the maximum daily loss, or maximum position size).

Automated Risk Controls Find out whether the system is able to enforce the risk management policy based on predefined parameters.

Manual overrides: Make sure that your platform allows manual overrides in emergency situations.

User feedback from reviewers and case studies

User reviews: Research user feedback to gauge the platform's effectiveness in managing risk.

Case studies: Check for case studies or testimonials that showcase the platform's strengths in risk management.

Community forums: See whether the platform hosts an active user community in which traders discuss risk management tips and strategies.

Bonus Tips

Trial time: You may avail a demo or a free trial to try out the risk management tools available on the platform.

Customer support - Ensure that your platform provides a solid support for issues and questions related to risk.

Look for educational resources.

These guidelines will allow you to assess the risk management abilities of AI analysis and stock prediction platforms. In this way, you'll be able to select a platform that protects your capital and limits potential losses. For trading success and to make sense of volatile markets, reliable risk management tools are crucial. Read the top stock trading ai for website tips including stock trading ai, best ai stock prediction, free ai stock picker, ai stock trader, best ai stock prediction, investing with ai, ai for trading stocks, how to use ai for stock trading, best stock prediction website, ai options and more.